|

|

|

Cathy Bergeron, DESS Fisc., CPA, CA

Associée déléguée

BDO Canada s.e.n.c.r.l. |

Sylvain Thibeault, avocat, M.Fisc.

Directeur principal, Taxes indirectes

BDO Canada s.e.n.c.r.l. |

Quebec's finance minister, Carlos Leitão, handed down his fifth budget on March 27, 2018 and the fourth balanced budget in a row. One of the government's stated goals is to reduce the tax burden on small and medium-sized businesses (SMBs).

Brief summaries of the announced measures that we have identified and that could have an impact on insurance brokerage firms in Quebec are provided below.

Compensation tax for financial institutions

Together with the announcement of QST/GST harmonization in the financial sector, the compensation tax has been eliminated for insurance brokerages. This measure applies to all firms except those that elect to make "exempt supplies" with certain major financial institutions under Canada's Excise Tax Act. The announcement that the compensation tax for financial institutions will be extended for another five years does not change this situation in any way.

Insurance brokerage firms in Quebec will not be affected by this announcement, unless they make the election under Section 150 of the Excise Tax Act with respect to certain major financial institutions.

Reduced tax burden on SMBs

The 2018-2019 Quebec budget brings in various measures designed to reduce the tax burden on SMBs. These include uniform tax rates for SMBs and gradual reductions in Quebec health services fund contribution rates (FSS) for all SMBs.

The small business deduction (SBD) rate for businesses operating in industries other than the primary (e.g. natural resources) and manufacturing sectors, such as eligible insurance brokerages, will be gradually reduced to 4% by 2021. This measure applies to tax years ending after March 27, 2018.

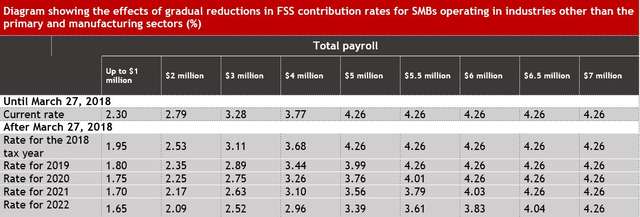

In addition, changes will be made to how employers' contributions to the provincial health services fund (FSS) are calculated, effective March 28, 2018. For SMBs in the services and construction sectors, FSS contribution rates will be modified as follows:

Additional capital cost allowance

Back in March 2017, Quebec brought in a 35% additional capital cost allowance aimed at accelerating business investments and enhancing competitiveness, particularly as regards "general-purpose electronic data processing equipment" (e.g. computers). This deduction will be replaced by a new additional deduction of 60% for new "property" (e.g. equipment/software) acquired between March 27, 2018 and April 1, 2020.

Enhanced refundable tax credit for on-the-job training

A number of changes/enhancements have been announced with respect to the refundable tax credit for on-the-job training:

1. The weekly cap for eligible expenses and the maximum rate for this credit will be increased for all eligible trainees.

2. To encourage employers to offer more training for Aboriginals, the tax credit rate will be increased for that group.

3. The tax credit rate will be increased for eligible training in Quebec's resource regions.

These measures apply to training activities beginning after March 27, 2018.

Refundable tax credit to support qualifying training for workers in SMBs

A new refundable tax credit will be introduced for SMBs with payrolls of under $7 million. Up to $5,460 per year may be obtained for each eligible employee taking part in qualifying training (training must be provided via a recognized educational institution). This measure applies to training expenses incurred between March 27, 2018 and January 1, 2023.

Quebec sales tax (QST) measures

The introduction of a new registration model for foreign or Canadian suppliers without a physical or significant presence in Quebec is sure to have an impact on self-assessment requirements for insurance brokerages.

Currently, insurance brokerage firms that acquire or import tangible personal property, intangible personal property (e.g. software) or services from outside Quebec provided by suppliers that are not resident in Quebec and not registered for QST purposes for use in the firms' exempt activities are required to self-assess for QST purposes. It should be noted that this requirement also applies to the GST when acquiring property from Canadian suppliers that are not Quebec residents.

By extending the number of registered suppliers (i.e. by including foreign or Canadian suppliers without a physical or significant presence in Quebec), QST self-assessment requirements should be reduced. It remains to be seen whether the federal government will follow suit as regards the GST/HST.

Conclusion

As mentioned above, we have identified certain announced measures that could have an impact on insurance brokerage firms in Quebec. The measures are summarized very briefly. In all cases, you are advised to consult a tax specialist or a BDO Canada tax advisor to identify all measures that could apply to your particular situation.