A text from Echelon

By Mark Johnston, Manager Technical Risk Services

Insurers and Brokers are in a prime position to help commercial clients prevent costly losses before they occur. At Echelon, we want to work directly with those we serve and help them protect what matters most, including their people, property, and bottom line. As a leading Specialty insurer, we’ve put together some tips to help Brokers and their clients take a closer look at the risks in their businesses.

So, what does it mean to “take a closer look?

Commercial environments are complex and constantly changing. It’s important to ask the right questions and dig into the finer details of a client’s operations to understand where risk is most likely to have an impact. These deeper discussions can better inform the solutions you propose to manage a client’s risk and demonstrate that you value their story and are truly in their corner.

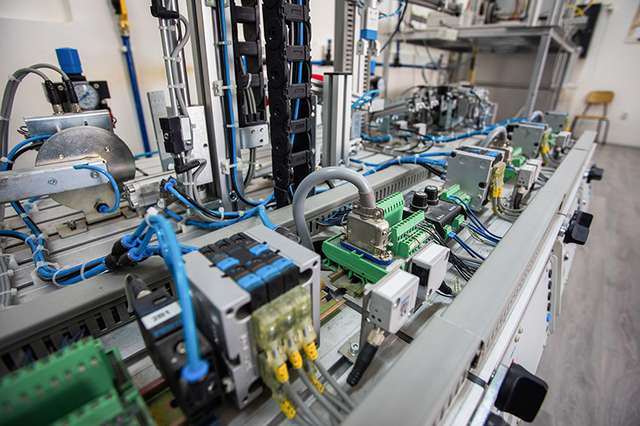

For example, let’s say a small manufacturer comes to you for a new insurance solution. As you conduct your risk assessment, you find their sprinkler system, while fully operational, doesn’t adequately protect their entire building in the event of a fire – something they’ve long been unaware of. As this poses a significant financial and human risk, you work with the client to determine which upgrades are required and support them through making it happen.

Because you took a closer look, that manufacturer now has a policy that safeguards them against loss and provides the peace of mind that potential risks have been addressed. And it wasn’t complicated, you just had to know what to look for.

Here are a few less obvious questions to help you uncover a client’s full story:

- Are their fire protection systems properly inspected, tested, and maintained?

- Do they engage in proper housekeeping to avoid the accumulation of combustible materials?

- Are their facilities protected against water intrusion from weather events and standing water?

- Does the client have an operational security infrastructure to protect against theft or possible arson?

- Are there cybersecurity measures in place to prevent breaches of confidential or proprietary data?

- Have employees received appropriate training to ensure safe operation of equipment or to manage potential risk?

Questions like these pull the curtain back on hidden risks that may impact your client’s business – but that’s only half the battle. We can and must stay several steps ahead with preventative tools and tactics that will bring clients back to their feet quickly when loss is at their doorstep.

Here are some elements to consider or recommend that will strengthen your client’s business continuity efforts:

- Is there a formal plan in place for the impacted location? There should be employees assigned to activate the plan and ensure its ongoing maintenance.

- Have partnerships been established to help navigate a claim or loss? These include reliable providers of spare supplies and pre-arranged service contracts to quickly solve problems that may arise with critical equipment.

- Has a temporary operating facility been considered in the event of a closure? Think of a secondary warehouse to store goods or nearby hotels where guests could be relocated.

If or when loss happens, a rock-solid continuity plan can help keep losses to a minimum and prevent any long-term interruptions. This means your client can get back to business as usual, knowing that you helped them weather the storm.

Every client’s story matters, and by listening carefully and taking that all-important “closer look,” you can stand behind that story as you advise on Specialty solutions that meet their unique needs. Like the manufacturer that needed to upgrade its sprinkler system, understanding what to look for and how risk can be addressed is key to your loss prevention and risk mitigation efforts.

And for us at Echelon, these tips, and indeed all the expertise we share, are part of our commitment to helping you take this closer look for your clients.

Copyright © 2022 Echelon Insurance. All rights reserved. This article is provided for general information purposes. For specific client situations, we invite brokers to contact Echelon Insurance.