Initiated in 2018, the Data Exchange Project (D/X) is backed by the Insurance Brokers Association of Canada (IBAC). It consists of an action plan setting out steps to be followed so brokers' and insurers' technological tools can connect and communicate in real time. This initiative encompasses a variety of stakeholders, including a group of insurers and management tool suppliers known as the Data Exchange Connect Alliance (DECA).

What does an electronic data exchange involve?

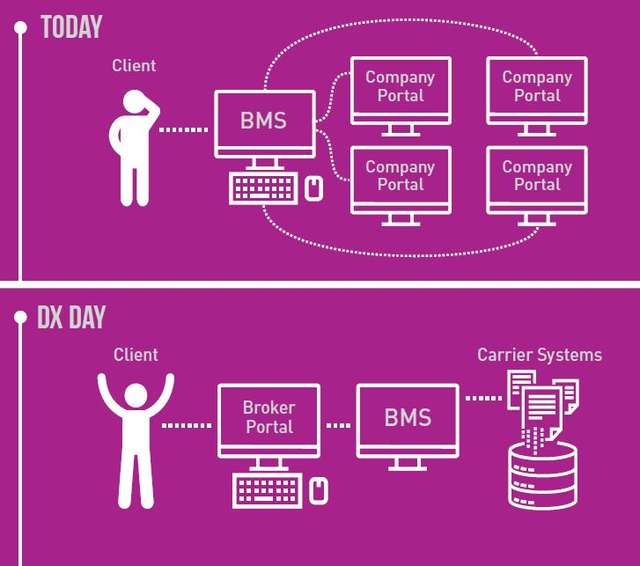

An electronic data exchange (or interchange) (EDI) involves a communication system that helps to improve connectivity. The D/X Project seeks to facilitate real-time connections between insurers' and brokers' IT systems, subject to CSIO standards.

Thanks to this system, insurance company portals are no longer required. The EDI process ensures instant access to accurate data, policy information and updates. In other words, there are no more intermediaries between clients and brokers as the latter directly receive required information and other data in their IT ecosystems.

DECA's mission

DECA brings together a group of insurers and management tool suppliers taking part in the development of high-tech solutions designed to address the challenges facing the brokerage industry. Having achieved a critical mass of insurers and suppliers, the group is now implementing a number of important client service operations, e.g. developing application programming interfaces (APIs) for billing and compensation claims.

Why is this initiative necessary?

IBAC initiated the D/X Project because there is no uniform set of standards governing high-tech solutions available in the marketplace. Since the current solutions are so highly personalized, they are hard for all brokers to integrate within their day-to-day operations. The underlying idea, therefore, is to initially standardize the processes involved and to create a unique easy-to-use solution meeting the needs of all industry stakeholders. Emphasis will then be placed on automating, modernizing and strengthening the new system so brokers can keep on meeting clients' needs effectively.

D/X Project objectives

The initiative, essentially based on transaction type, aims to:

- Standardize communications at the insurer level.

- Give brokers real-time access to data so they can deal with client requests easily and swiftly.

- Create a common data library for various stakeholders (brokers, insurers, suppliers).

- Eliminate processing delays.

- Provide reliable and accurate information.

- Boost brokers' efficiency.

- Improve the client experience.

- Enhance client service.

- Reduce costs.

CSIO's role

The Centre for Study of Insurance Operations (CSIO) is Canada's national standards association for P&C insurers, brokers and software suppliers. It is responsible for implementing standards with a view to improving the brokerage network's effectiveness and competitiveness. It does so in part by overseeing the development and maintenance of the D/X Project.

Brokers' roles and responsibilities

More and more, individuals are seeking instant (or "real-time") client service. If brokers cannot meet that requirement, they will lose business.

Among the various steps that brokerages will need to take during their digital transition, becoming familiar with the D/X Project and its client experience benefits will be essential. Here is a short presentation describing the initiative.

Brokers can promote the D/X Project among insurers and management system suppliers by encouraging them to take part in key client service-related operations. That way, brokers will have a chance to access new solutions enabling them to meet their clients' evolving expectations.